The most inconvenient periods may come up for loan repayments and other obligations. For a missed loan payment, here are some ideas.

If you can’t pay back a debt, it’s not the end of the world. Even though loan companies truly want to help their clients, they are usually misunderstood.

Examine the following possibilities if you are unable to pay back a loan.

First and foremost, what happens if you do not repay your debt?

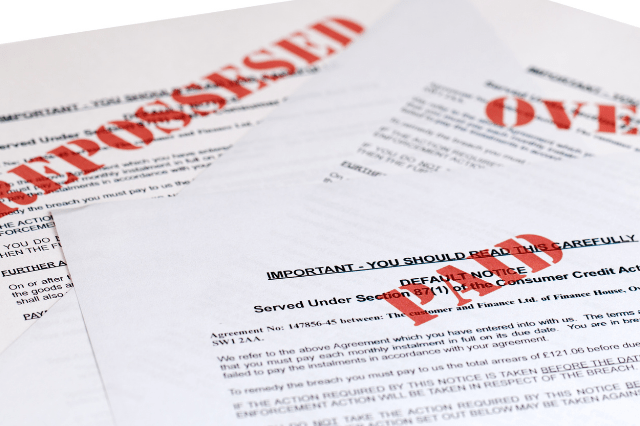

You will be in default if you don’t make a loan payment. Your credit report will almost probably reflect this (also known as a credit file). Your credit score may suffer as a result, making it more challenging to borrow money in the future. On the other hand, credit scores can be raised over time.

Lenders typically get in touch with customers who miss loan instalments. They will be looking for the borrower to make up the shortfall and finish the payment as soon as possible.

What happens if I take a long time to pay back my loan?

Your credit score will be further harmed if you repeatedly miss payments. The lender might then file a lawsuit against you, in which case your car might be taken back.

Anyone would agree that it would be wise to avoid this situation.

So, what are your choices?

Reach out to your lender.

Some debtors are reluctant to call their lender when times are difficult. It is not necessary. We’ve all learned from COVID that circumstances change, and lending institutions are fully aware of this.

Always bear in mind that loan companies work hard to provide top-notch customer service. This entails getting to know their clients and helping them come up with a solution.

Lenders might be able to suggest ways to save money, alter the length of the loan and the amount that must be repaid, or temporarily lower the payment with the purpose of making it up later.

A lender’s hardship team is typically available to assist borrowers with the aforementioned problems.

Make sure you are prepared with some information before phoning your lender. They might need specific information about your income or position in order to assist you in the best way possible.

Get in touch with financial assistance

Seeking debt reduction assistance if you are unable to pay back a loan is a wise move to determine your situation. Having knowledge is always helpful when you need assistance.

You will frequently need to discuss your financial struggles, but these people are available to support you.

Selling or trading in their car may be a sensible option for certain borrowers. Selling the vehicle and using the cash to pay off the loan’s outstanding balance may be a reasonable option for some borrowers who are unable to make loan payments.

To be sure you’re doing everything correctly, be sure to first speak with your lender and review your loan agreement.

Make certain that;

You can get around without a car.

You know for sure that you won’t be able to pay back the debt.

The selling of the car won’t have any impact on any commitments you might have to your family.

Your plans have been fully disclosed to your lender.

Loan refinancing

People who can’t or don’t want to make their loan instalments might consider refinancing as a possible solution.

The process of refinancing is taking out a new loan to settle an existing one. Naturally, you’ll want to make sure that the new loan offers you better terms and more benefits than your current one.

It may first seem strange to take out a new loan to pay off an existing debt, but doing so can offer longer loan terms (the period you have to repay the loan), which can lead to lower monthly payments. More money is therefore readily available.

Some debtors can be qualified for lower interest rates.

If you’re interested in refinancing a debt or learning more, get in touch with the Loan-s team right away.

It everything comes down to you in the end.

If you are unable to repay a loan, you are not alone. Many debtors need to reorganise their finances due to a change in circumstances.

Refusing to ask for help or contact your lender is the worst thing you can do. When in doubt, get professional assistance as soon as you can.

Contact Us today, and let Loan-s approve your loan fast.We are waiting to welcome you on 1300 663 983.